Make A Deposit

Send money through a direct deposit Send income directly from your employer, the government (including tax refunds), or other sources electronically to your Vanguard account. Set up direct deposit Use an online bill paying service. To make direct deposits through your employer or payroll provider, provide them with your Chime routing number and Spending Account number. Chime takes care of the rest. Your funds will automatically post to your Chime Spending Account as soon as we receive them.

1. External AccountYou can link your checking or savings account to an account you have at another bank. Doing so lets you easily transfer funds between your accounts.Learn how to link an external account online.

2. Mobile DepositDeposit a check from anywhere in the U.S. and U.S. territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check:

- Go to the Capital One Mobile app and select your account.

- Click on “Deposit” next to the camera icon.

- Take photos of the front and back of your check (please write "for Capital One mobile deposit" and sign your name on the back of the check prior to taking your picture).

- Follow the prompts to fill out the deposit amount and, if you’d like, a memo.

- Slide your finger across the green button to complete your deposit.

3. ATM DepositIf you live near a Capital One Café or Capital One Bank location, you can make a check deposit at the ATM at that location. Find out if there’s one near you.

4. Direct DepositYou can set up Direct Deposit by giving your Capital One account number and routing number to your employer. You can find that information either:

- In the app: Sign in and select your bank account. Scroll down to “Account Info” and select “Show More.”

- Online: Sign in and select your bank account. Click on “View Details” underneath the name of your account in the top left corner

You can also set up Direct Deposit by printing out our blank Direct Deposit form, filling in your information and giving it to your employer.

5. Make a transferVisit our Transfers page to learn more about making a transfer.

For more information about how long it takes for money to move in and out of your account, please visit the Funds Availability Page.

'>1. External AccountYou can link your checking or savings account to an account you have at another bank. Doing so lets you easily transfer funds between your accounts.

Learn how to link an external account online.

2. Mobile DepositDeposit a check from anywhere in the U.S. and U.S. territories with Mobile Deposit. Follow these steps on our mobile app to snap a picture of your check:

- Go to the Capital One Mobile app and select your account.

- Click on “Deposit” next to the camera icon.

- Take photos of the front and back of your check (please write 'for Capital One mobile deposit' and sign your name on the back of the check prior to taking your picture).

- Follow the prompts to fill out the deposit amount and, if you’d like, a memo.

- Slide your finger across the green button to complete your deposit.

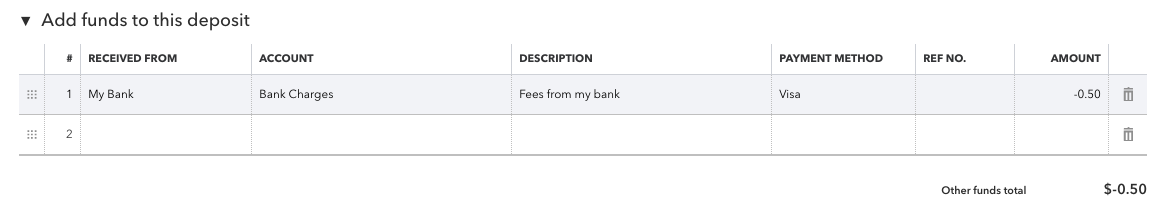

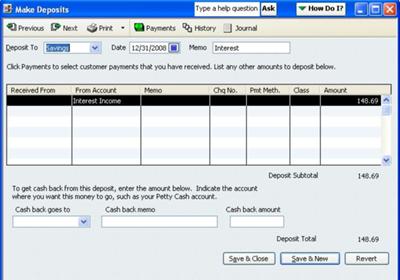

Make A Deposit In Qbo

3. ATM DepositIf you live near a Capital One Café or Capital One Bank location, you can make a check deposit at the ATM at that location. Find out if there’s one near you.

4. Direct DepositYou can set up Direct Deposit by giving your Capital One account number and routing number to your employer. You can find that information either:

- In the app: Sign in and select your bank account. Scroll down to “Account Info” and select “Show More.”

- Online: Sign in and select your bank account. Click on “View Details” underneath the name of your account in the top left corner

You can also set up Direct Deposit by printing out our blank Direct Deposit form, filling in your information and giving it to your employer.

Quickbooks Online Make A Deposit

5. Make a transferVisit our Transfers page to learn more about making a transfer.

For more information about how long it takes for money to move in and out of your account, please visit the Funds Availability Page.

Online Deposits (Credit Card)

GET Funds allows students or guests to make a Titan Dollars deposit online at anytime using a credit card. It also provides the ability to view your balance, transaction history and report your TitanCard lost.

Students, Faculty & Staff

The online deposit site will allow you to view your transaction history, check your balance, report your TitanCard lost and securely deposit funds to your Titan Dollars account using your credit card. You will need to know your UWO NetID to login.

Guests & Affiliates

The online deposit site will allow you to securely deposit funds to your student’s Titan Dollars account or Affiliate TitanCard (starts will (99XXXXX) using a credit card. You will need to know your student’s 7-digit student ID (AKA “Campus ID”) number or Affiliate ID number to deposit funds.

Departments

Departments can also add Titan Dollars to department cards by using the form below.

Online Deposits (Student Account)

Students are allowed to charge up to $500 in Titan Dollars to their student accounts. This includes the Titan Dollars $150 allocation for students living in the residence halls.

In Person (Cash, Check, Credit Card or Student Account*)

Titan Central

Reeve Union, First floor

Self-Serve Machine ($1, $5, $10 & $20 bills only)

Scott Hall

Make check payable to UW Oshkosh and include student ID number

Mail to:

UW Oshkosh

Titan Central

748 Algoma Blvd.

Oshkosh, WI 54901

*Student Account Note: Students are allowed to charge up to $500 in Titan Dollars to their student account per semester. The $150 Titan Dollars deposited as part of the Student Convenience Program for those living in the dorms counts towards the $500 limit. Students who wish to charge Titan Dollars to their student account must have an account that is in good standing; meaning there are no financial holds on your account. If you do have a financial hold on your account please contact the Student Accounts office to resolve the hold.

Your TitanCard is property of UW Oshkosh, which reserves the right to revoke its use or any accounts at any time. A TitanCard may only be used by the person to whom it is registered and is non-transferable. If an unauthorized user presents a TitanCard to a cashier, the card will be confiscated. A TitanCard is valid as long as you are enrolled or employed at UW Oshkosh, exception applies to authorized guests. UW Oshkosh reserves the right to close any account that has been inactive for a period of 12 months.

Full Disclosure Statement

UW Oshkosh receives financial support of student programs and services from UW Credit Union. All provisions of the financial package are based on a flat guarantee. The University formed the partnership after a competitive selection process.

No credit card provisions or loans will be granted as part of the TitanCard program.

Make A Deposit

TitanCard Policies Titan Dollars Policies